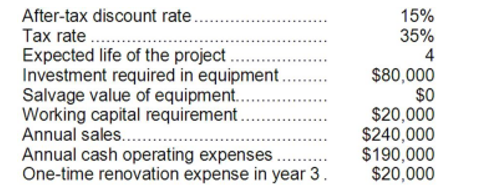

Glasco Corporation has provided the following information concerning a capital budgeting project:

The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The income tax expense in year 3 is:

Definitions:

Budgets

Financial plans that estimate revenue and expenditures over a specific time period.

Potential Bottlenecks

Points in the production process that can cause delays due to limited capacity or resources, impacting overall productivity.

Cash Collections

The total amount of money received from customers over a period, including payments for goods or services sold.

Schedule Of Cash Collections

A detailed plan that shows when a company expects to receive cash from accounts receivable or other revenue sources.

Q21: The current ratio at the end of

Q28: Bowdish Corporation purchases potatoes from farmers. The

Q38: Under the direct method of determining the

Q41: Faniel Corporation has provided the following information

Q118: The income tax expense in year 2

Q140: Suppose the special order is for 6,000

Q146: (Ignore income taxes in this problem.) The

Q155: Roddey Corporation is a specialty component manufacturer

Q176: Costabile Corporation is considering dropping product G41O.

Q180: The company's price-earnings ratio for Year 2