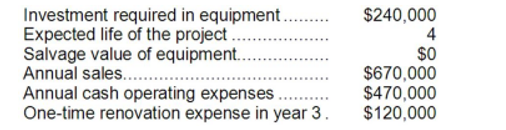

Foucault Corporation has provided the following information concerning a capital budgeting project:

The company's income tax rate is 35% and its after-tax discount rate is 12%. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The income tax expense in year 2 is:

Definitions:

Intangible Assets

Non-physical assets possessed by a business, such as patents, trademarks, and goodwill, which can generate economic benefit.

Cash Flow

The total amount of money being transferred in and out of a business, especially as affecting liquidity.

Assets

Economic resources or owned valuables that an individual, company, or country possesses, which are expected to provide future benefits.

Dividends

A corporation allocates a segment of its profits to its shareholders in the form of payments, distributing its earnings among them.

Q15: For performance evaluation purposes, how much (if

Q69: In capital budgeting computations, discounted cash flow

Q75: A study has been conducted to determine

Q82: (Ignore income taxes in this problem.) The

Q90: Which of the following is correct regarding

Q107: The income tax expense in year 2

Q109: The current ratio at the end of

Q155: (Ignore income taxes in this problem.) Naomi

Q184: Lindboe Corporation has provided the following financial

Q278: Feiler Corporation has total current assets of