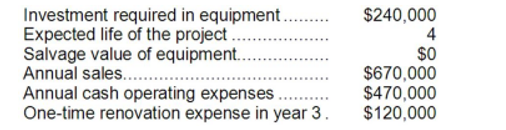

Foucault Corporation has provided the following information concerning a capital budgeting project:

The company's income tax rate is 35% and its after-tax discount rate is 12%. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The total cash flow net of income taxes in year 3 is:

Definitions:

Subsidies

Financial assistance granted by the government to individuals, organizations, or industries to support business activities and encourage economic growth.

Special Taxes

Levies imposed on specific goods, services, or activities, often with the intention of discouraging usage or generating revenue for targeted purposes, distinct from broad-based taxes like income tax.

Tariff

A tax imposed by a government on imports or exports of goods and services.

Import Quota

A government-imposed limit on the amount or value of goods that can be imported into a country over a specified period of time, usually to protect domestic industries.

Q9: Kaze Corporation's cash and cash equivalents consist

Q16: Mujalli Corporation is considering a capital budgeting

Q19: On the statement of cash flows, the

Q25: Wilson Company maintains a cafeteria for its

Q33: The company's equity multiplier at the end

Q35: In capital budgeting computations, discounted cash flow

Q48: Ignoring any salvage value, to the nearest

Q72: The income tax expense in year 2

Q93: The working capital at the end of

Q143: (Ignore income taxes in this problem.) Galindo