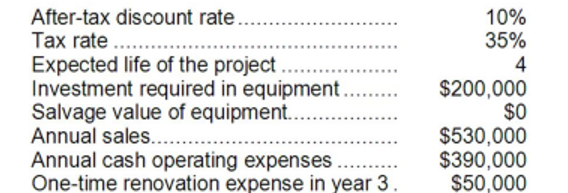

Gouker Corporation has provided the following information concerning a capital budgeting project:

The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The total cash flow net of income taxes in year 3 is:

Definitions:

Contribution Margin

The amount by which sales revenue exceeds variable costs. It represents the portion of sales that helps to cover fixed costs.

Bottleneck Hour

The time period in a production process where the flow is constricted due to limitations in capacity or resources, causing delays.

Variable Cost Method

An accounting approach where variable costs are expensed as incurred and fixed costs are systematically allocated over time, typically used in costing and decision-making.

Cost-Plus Approach

A pricing strategy where the selling price is determined by adding a specific markup to a product's cost.

Q4: Erastic Corporation has $14,000 in cash, $8,000

Q6: The total cash flow net of income

Q11: The present value of the annual cost

Q12: Which of the following statements is correct?<br>A)Project

Q25: On the statement of cash flows, the

Q33: (Ignore income taxes in this problem.) Avanca

Q55: (Ignore income taxes in this problem.) Weilbacher

Q71: Juett Company produces a single product. The

Q204: The company's earnings per share for Year

Q233: The company's total asset turnover for Year