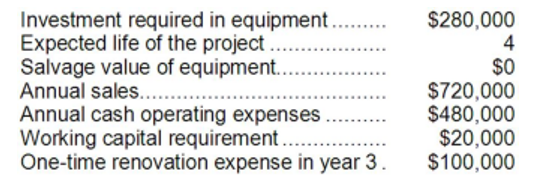

Erling Corporation has provided the following information concerning a capital budgeting project:

The company's income tax rate is 35% and its after-tax discount rate is 15%. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The total cash flow net of income taxes in year 2 is:

Definitions:

Auditory Stimuli

Sounds or noises that evoke a response from the auditory system.

Reaction Time

The amount of time it takes to respond to a stimulus.

Gross Motor Skills

The abilities required to control the large muscles of the body for walking, running, sitting, crawling, and other activities.

Attention-Deficit/Hyperactivity Disorder

A neurodevelopmental disorder characterized by persistent issues with attention, hyperactivity, and impulsiveness.

Q3: The net cash provided by operating activities

Q6: If a portion of the actual cost

Q20: Under the direct method of determining the

Q23: The accounts receivable turnover for Year 2

Q39: Lopez Company has a purchasing department that

Q46: The average collection period for Year 2

Q80: Kosakowski Corporation processes sugar beets in batches.

Q141: Smay Corporation has provided the following

Q150: Suppose Melrose can sell 68,000 units of

Q251: For Year 2, Etzkorn Corporation's sales were