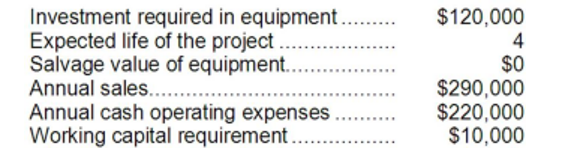

Helfen Corporation has provided the following information concerning a capital budgeting project:

The company's income tax rate is 35% and its after-tax discount rate is 13%. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The net present value of the entire project is closest to:

Definitions:

Central Facility

A primary location or infrastructure that supports operations and services within an organization or network.

Optimal Shipping

The process of determining the most cost-effective and efficient method of distributing products from one point to another.

Unfavorable Exchange Rates

Exchange rates that result in a decrease in the home currency value compared to a foreign currency, potentially leading to higher costs for importing goods and services.

Location Decision

The process of choosing a geographical location for a company's operations, considering factors like market access, costs, and legal regulations.

Q34: If a company has computed a project

Q40: The net present value of the entire

Q41: Digby Corporation's balance sheet and income statement

Q52: The net cash provided by (used in)

Q72: (Ignore income taxes in this problem.) Veys

Q111: Pulkkinen Corporation has provided the following information

Q114: Bourret Corporation has provided the following information

Q124: Data from Ben Corporation's most recent balance

Q211: The company's times interest earned for Year

Q237: Klein Corporation has provided the following