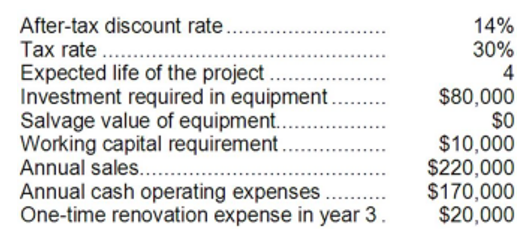

Starrs Corporation has provided the following information concerning a capital budgeting project:

The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The net present value of the entire project is closest to:

Definitions:

Status Indicators

Visual or auditory signals (such as LEDs or beeps) on devices or equipment that show their current operating condition, such as on/off, error, or operational status.

Output Module

A component in PLC systems that provides physical output based on the program logic, like activating motors or lights.

Optical Isolator

A device that uses light to transfer an electrical signal between elements of a system while keeping them electrically isolated.

Electrical Noise Interference

Unwanted disturbances superimposed on a useful signal that degrade the quality of signal transmission or processing.

Q2: (Ignore income taxes in this problem.) You

Q6: (Ignore income taxes in this problem.) The

Q20: The income tax expense in year 2

Q32: The debt-to-equity ratio at the end of

Q107: The income tax expense in year 2

Q123: When cash flows are uneven and vary

Q164: Bullinger Corporation has provided the following data

Q201: Groeneweg Corporation has provided the following data:

Q272: The company's net profit margin percentage for

Q281: The working capital at the end of