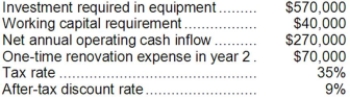

Soffer Corporation has provided the following information concerning a capital budgeting project:  The expected life of the project and the equipment is 3 years and the equipment has zero salvage value. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment and the depreciation expense on the equipment would be $190,000 per year. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The net annual operating cash inflow is the difference between the incremental sales revenue and incremental cash operating expenses.

The expected life of the project and the equipment is 3 years and the equipment has zero salvage value. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment and the depreciation expense on the equipment would be $190,000 per year. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The net annual operating cash inflow is the difference between the incremental sales revenue and incremental cash operating expenses.

Required:

Determine the net present value of the project. Show your work!

Definitions:

Transition Periods

Phases in life or processes during which significant change occurs, transitioning from one state to another.

Generativity

A concern for establishing and guiding the next generation, often expressed through parenting or contributions to society.

Ego Integrity

A sense of wholeness and fulfillment achieved in old age, reflecting back on life with a sense of completeness and satisfaction, according to Erik Erikson's stages of psychosocial development.

Generativity

A concern for people besides oneself that usually develops during middle age, involving guiding the next generation or contributing to the well-being of others through creativity and productivity.

Q1: The net cash provided by (used in)

Q6: (Ignore income taxes in this problem.) The

Q18: Excerpts from Deblois Corporation's comparative balance sheet

Q44: (Ignore income taxes in this problem.) Flamio

Q44: The free cash flow for the year

Q45: In the payback method, depreciation is deducted

Q49: For performance evaluation purposes, how much fixed

Q147: When using internal rate of return to

Q148: (Ignore income taxes in this problem.) The

Q171: Teich Inc. is considering whether to continue