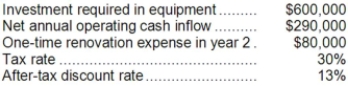

El Corporation has provided the following information concerning a capital budgeting project:  The expected life of the project and the equipment is 3 years and the equipment has zero salvage value. The company uses straight-line depreciation on all equipment and the depreciation expense on the equipment would be $200,000 per year. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The net annual operating cash inflow is the difference between the incremental sales revenue and incremental cash operating expenses.

The expected life of the project and the equipment is 3 years and the equipment has zero salvage value. The company uses straight-line depreciation on all equipment and the depreciation expense on the equipment would be $200,000 per year. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The net annual operating cash inflow is the difference between the incremental sales revenue and incremental cash operating expenses.

Required:

Determine the net present value of the project. Show your work!

Definitions:

Ritualism

The excessive or inappropriate repetition of rituals, typically seen in religious or cultural practices but can also reflect certain psychiatric conditions.

Primary Dentition

Refers to the first set of teeth in the growth development of humans and many animals, also known as baby or milk teeth.

Primary Dentition

The first set of teeth in the human dentition cycle, also known as baby or milk teeth, typically includes 20 teeth.

Sphincter Control

The ability to regulate the muscles that close and open passages in the body, crucial for bowel and bladder management.

Q42: (Ignore income taxes in this problem.) Crowley

Q46: The ending balance of accounts receivable was

Q49: A profit center is responsible for generating

Q80: The net present value of the entire

Q113: Beltram Corporation's balance sheet and income statement

Q125: The net cash provided by (used in)

Q137: The company's average sale period (turnover in

Q148: (Ignore income taxes in this problem.) The

Q162: (Ignore income taxes in this problem.) Tidwell

Q166: (Ignore income taxes in this problem) The