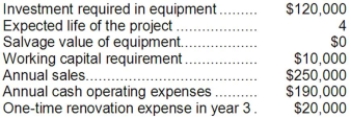

Forehand Corporation has provided the following information concerning a capital budgeting project:  The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation. The depreciation expense will be $30,000 per year. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The income tax rate is 30% and the after-tax discount rate is 10%.

The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation. The depreciation expense will be $30,000 per year. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The income tax rate is 30% and the after-tax discount rate is 10%.

Required:

Determine the net present value of the project. Show your work!

Definitions:

Q27: Mota Corporation has provided the following information

Q42: (Ignore income taxes in this problem.) Crowley

Q66: The total cash flow net of income

Q74: Menghini Corporation is considering a capital budgeting

Q88: Assume that sufficient constraint time is available

Q89: If Madison has a limit of 10,000

Q103: Suppose the special order is for 4,000

Q114: Glocker Company makes three products in a

Q192: The company's equity multiplier at the end

Q253: Arkin Corporation's total current assets are $290,000,