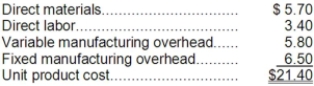

A customer has requested that Gamba Corporation fill a special order for 3,000 units of product Q41 for $25.00 a unit. While the product would be modified slightly for the special order, product Q41's normal unit product cost is $21.40:  Direct labor is a variable cost. The special order would have no effect on the company's total fixed manufacturing overhead costs. The customer would like modifications made to product Q41 that would increase the variable costs by $7.00 per unit and that would require an investment of $15,000 in special molds that would have no salvage value. This special order would have no effect on the company's other sales. The company has ample spare capacity for producing the special order. If the special order is accepted, the company's overall net operating income would increase (decrease) by:

Direct labor is a variable cost. The special order would have no effect on the company's total fixed manufacturing overhead costs. The customer would like modifications made to product Q41 that would increase the variable costs by $7.00 per unit and that would require an investment of $15,000 in special molds that would have no salvage value. This special order would have no effect on the company's other sales. The company has ample spare capacity for producing the special order. If the special order is accepted, the company's overall net operating income would increase (decrease) by:

Definitions:

Variable Cost

Costs that change in proportion to the level of goods or services produced, such as materials and direct labor.

Units Sold

The total quantity of products that a company sells during a specific period.

Production Costs

The total expenses incurred in the process of manufacturing or producing goods, including raw materials, labor, and overhead costs.

Intermediate Calculations

Preliminary steps or calculations made to derive a final result or outcome in a series of mathematical or financial processes.

Q7: The fixed manufacturing overhead volume variance for

Q8: The standards for product F28 call for

Q31: In September, the Universal Solutions Division of

Q85: Mccubbin Corporation keeps careful track of the

Q102: Rank the projects according to the profitability

Q107: Two or more products produced from a

Q110: A cost center is not a responsibility

Q111: Pulkkinen Corporation has provided the following information

Q124: (Ignore income taxes in this problem.) Tangen

Q136: Mitchener Corp. manufactures three products from a