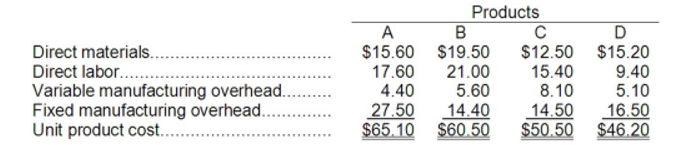

Brown Corporation makes four products in a single facility. These products have the following unit product costs:

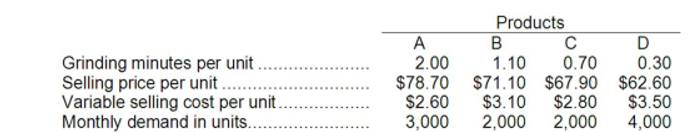

Additional data concerning these products are listed below.

The grinding machines are potentially the constraint in the production facility. A total of 10,500 minutes are available per month on these machines.

Direct labor is a variable cost in this company.

-How many minutes of grinding machine time would be required to satisfy demand for all four products?

Definitions:

Taxes

are compulsory financial charges or some other type of levy imposed upon a taxpayer by a governmental organization in order to fund government spending and various public expenditures.

Domestic Output

The total value of all goods and services produced within a country's borders in a specific time period, often referred to as Gross Domestic Product (GDP).

Industrially Advanced Countries

Nations with highly developed economies characterized by significant industrial growth, technological advancement, and high standard of living.

Progressive Tax

A tax system where the tax rate increases as the taxable amount or income grows, aiming at a fairer distribution of wealth.

Q2: (Ignore income taxes in this problem.) You

Q10: The budget variance for February is:<br>A)$7,440 F<br>B)$7,440

Q39: Lopez Company has a purchasing department that

Q47: Pardun Corporation's management keeps track of the

Q55: Gierlach Beet Processors, Inc., processes sugar beets

Q59: Globe Manufacturing Company has just obtained a

Q63: When used in return on investment (ROI)

Q69: If the equipment is rebuilt, the present

Q77: The division's margin used to compute ROI

Q147: Kampmann Corporation is presently making part Z95