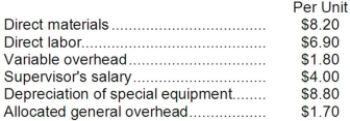

Part O43 is used in one of Scheetz Corporation's products. The company's Accounting Department reports the following costs of producing the 6,000 units of the part that are needed every year.  An outside supplier has offered to make the part and sell it to the company for $26.40 each. If this offer is accepted, the supervisor's salary and all of the variable costs, including direct labor, can be avoided. The special equipment used to make the part was purchased many years ago and has no salvage value or other use. The allocated general overhead represents fixed costs of the entire company. If the outside supplier's offer were accepted, only $1,000 of these allocated general overhead costs would be avoided.

An outside supplier has offered to make the part and sell it to the company for $26.40 each. If this offer is accepted, the supervisor's salary and all of the variable costs, including direct labor, can be avoided. The special equipment used to make the part was purchased many years ago and has no salvage value or other use. The allocated general overhead represents fixed costs of the entire company. If the outside supplier's offer were accepted, only $1,000 of these allocated general overhead costs would be avoided.

Required:

a. Prepare a report that shows the effect on the company's total net operating income of buying part O43 from the supplier rather than continuing to make it inside the company.

b. Which alternative should the company choose?

Definitions:

Gross Profit

The financial gain obtained after deducting the cost of goods sold from total sales revenue, representing the efficiency of core operations.

Inventory Turnover

A measure of how many times a company's inventory is sold and replaced over a period, indicating the efficiency of inventory management.

Average Daily Cost

The average daily cost refers to the total cost per day, calculated by dividing the total expenses by the number of days in the period under consideration.

Days' Sales

A financial metric that estimates the average time it takes a company to convert its inventory into sales.

Q37: If the actual rate per direct labor-hour

Q49: For performance evaluation purposes, how much fixed

Q53: The project profitability index is used to

Q54: The materials price variance for September is:<br>A)$11,020

Q57: Process Time is the only non-value-added component

Q58: The division's turnover used to compute ROI

Q60: The labor rate variance for June is:<br>A)$385

Q74: The simple rate of return on the

Q110: A cost center is not a responsibility

Q111: Reidenbach Corporation applies manufacturing overhead to products