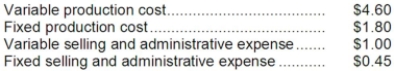

Globe Manufacturing Company has just obtained a request for a special order of 12,000 units to be shipped at the end of the current year at a discount price of $7.00 each. The company has a production capacity of 90,000 units per year. At present, Globe is only selling 80,000 units per year through regular channels at a selling price of $11.00 each. Globe's per unit costs at an 80,000 unit level of production and sales are as follows:  Variable selling and administrative expense will drop to $0.30 per unit on the special order units. The special order has to be taken in its entirety. This means that by accepting the special order, Globe will be forced to not sell 2,000 units to its regular customers.

Variable selling and administrative expense will drop to $0.30 per unit on the special order units. The special order has to be taken in its entirety. This means that by accepting the special order, Globe will be forced to not sell 2,000 units to its regular customers.

Required:

If Globe accepts this special order, by what amount will its net operating income increase or decrease? SHOW YOUR COMPUTATIONS.

Definitions:

Vocalizes

The act of producing sound or speech, often used in the context of how organisms, including humans, express themselves audibly.

Cools, Babbles

An expression indicating the early stages of an infant's vocal development characterized by making cooling and babbling sounds.

Months

are units of time in calendars that approximately correspond to the period of the lunar cycle, used to divide the year.

300-Word Vocabulary

A basic set of words that is sufficient for understanding and communicating basic ideas and needs.

Q9: Suppose that Division 1 sells 11,500 units

Q20: A company that is seeking to increase

Q24: A company has a standard cost system

Q34: The management of Leinberger Corporation is considering

Q40: Guerlane Fragrance Corporation has a perfume division,

Q49: (Ignore income taxes in this problem.) Farah

Q92: Moyer Corporation is a specialty component manufacturer

Q103: The total cash flow net of income

Q109: The variable overhead rate variance for the

Q169: Nicklin Corporation is considering two alternatives that