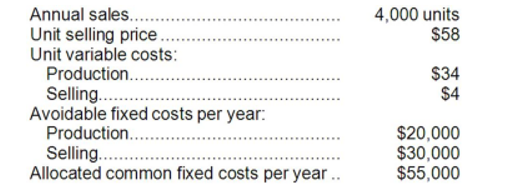

The Flint Fan Corporation is considering the addition of a new model fan, the F-27, to its current products. The expected cost and revenue data for the F-27 fan are as follows:

If the F-27 is added as a new product, it is expected that the contribution margin of other products will drop by $7,000 per year.

-If the F-27 product is added next year, the change in operating income should be:

Definitions:

Taxable Income

The amount of income that is used to calculate an individual's or a company’s income tax due, after exemptions and deductions.

Operating Income

Earnings before interest and taxes (EBIT), representing a company's profit from regular operations, excluding non-operational income and expenses.

Retained Earnings

Profits that a company has earned to date, less any dividends or other distributions paid to shareholders.

Dividends

Payments made by a corporation to its shareholder members. It is the portion of corporate profits paid out to stockholders.

Q5: Santistevan Corporation has provided the following information

Q10: Krenski Corporation has a Parts Division that

Q18: An unfavorable materials price variance is recorded

Q19: When the actual price to purchase a

Q23: The net present value and internal rate

Q27: The division's turnover is closest to:<br>A)0.27<br>B)2.92<br>C)10.99<br>D)2.31

Q41: In a decision to drop a product,

Q59: Based solely on the information above, the

Q96: Waste on the production line will result

Q171: Teich Inc. is considering whether to continue