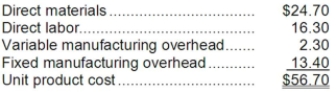

Foster Company makes 20,000 units per year of a part it uses in the products it manufactures. The unit product cost of this part is computed as follows:  An outside supplier has offered to sell the company all of these parts it needs for $51.80 a unit. If the company accepts this offer, the facilities now being used to make the part could be used to make more units of a product that is in high demand. The additional contribution margin on this other product would be $44,000 per year.

An outside supplier has offered to sell the company all of these parts it needs for $51.80 a unit. If the company accepts this offer, the facilities now being used to make the part could be used to make more units of a product that is in high demand. The additional contribution margin on this other product would be $44,000 per year.

If the part were purchased from the outside supplier, all of the direct labor cost of the part would be avoided. However, $5.10 of the fixed manufacturing overhead cost being applied to the part would continue even if the part were purchased from the outside supplier. This fixed manufacturing overhead cost would be applied to the company's remaining products.

Required:

a. How much of the unit product cost of $56.70 is relevant in the decision of whether to make or buy the part?

b. What is the net total dollar advantage (disadvantage) of purchasing the part rather than making it?

c. What is the maximum amount the company should be willing to pay an outside supplier per unit for the part if the supplier commits to supplying all 20,000 units required each year?

Definitions:

Drug Test

A drug test is a technical analysis of a biological specimen that's used to detect the presence or absence of specified parent drugs or their metabolites.

Moral Hazard

Moral hazard occurs when there is a lack of incentive to guard against risk where one is protected from its consequences, often after entering into a contract or agreement.

Deductible

The amount paid out of pocket by the policyholder before an insurance company covers a claim.

Full Replacement Value

An insurance term referring to the amount necessary to replace damaged or lost property with new items of like kind and quality without deducting for depreciation.

Q5: The materials quantity variance for June is:<br>A)$15,340

Q7: (Ignore income taxes in this problem.) You

Q7: The basic premise of the payback method

Q13: Soland Corporation has two operating divisions--an Atlantic

Q45: In the payback method, depreciation is deducted

Q50: The total cash flow net of income

Q66: If the denominator level of activity is

Q72: What was the Quilt Division's return on

Q103: When computing standard cost variances, the difference

Q120: The materials price variance for January is:<br>A)$2,755