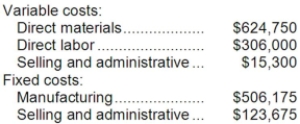

Adamyan Co. manufactures and sells medals for winners of athletic and other events. Its manufacturing plant has the capacity to produce 15,000 medals each month; current monthly production is 12,750 medals. The company normally charges $120 per medal. Cost data for the current level of production are shown below:  The company has just received a special one-time order for 700 medals at $83 each. For this particular order, no variable selling and administrative costs would be incurred. This order would also have no effect on fixed costs.

The company has just received a special one-time order for 700 medals at $83 each. For this particular order, no variable selling and administrative costs would be incurred. This order would also have no effect on fixed costs.

Required:

Should the company accept this special order? Why?

Definitions:

Sustainable Growth

Refers to an achievable growth rate that a company or economy can maintain without running into problems.

Profit Responsibility

The accountability of individuals or departments within an organization to meet specific profit targets or financial performance metrics.

Firm

A business organization, such as a corporation or partnership, engaged in commercial, industrial, or professional activities.

Owners

Individuals or entities that hold legal title to an asset, property, or business.

Q2: The Labor Rate Variance for December would

Q18: An unfavorable materials price variance is recorded

Q19: When the actual price to purchase a

Q31: Cajun Corporation manufactures a labor-intensive product. The

Q38: The fixed manufacturing overhead budget variance for

Q41: Faniel Corporation has provided the following information

Q62: The materials price variance for January is:<br>A)$4,875

Q106: The income tax expense in year 3

Q156: (Ignore income taxes in this problem.) Neighbors

Q167: The variable overhead efficiency variance for May