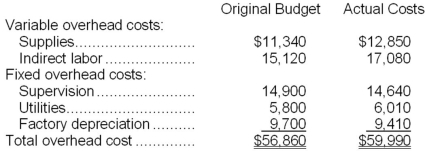

Semaan Corporation applies manufacturing overhead to products on the basis of standard machine-hours. Budgeted and actual overhead costs for the month appear below:  The company based its original budget on 2,700 machine-hours. The company actually worked 2,960 machine-hours during the month. The standard hours allowed for the actual output of the month totaled 3,030 machine-hours. What was the overall fixed manufacturing overhead budget variance for the month?

The company based its original budget on 2,700 machine-hours. The company actually worked 2,960 machine-hours during the month. The standard hours allowed for the actual output of the month totaled 3,030 machine-hours. What was the overall fixed manufacturing overhead budget variance for the month?

Definitions:

Individual Income Taxes

Taxes levied on the income of individuals, with the tax rate often varying according to income levels.

State

A politically organized body of people under a single government, often synonymous with "country" or "nation."

Local Governments

Administrative bodies that govern smaller geographical areas within a country, often responsible for local policies and laws, public services, and community issues.

U.S. Income Tax System

The federal government's structured method of collecting revenue from individuals and businesses based on their earnings, with varying rates and brackets.

Q2: Division A makes watzits. The company has

Q15: The labor rate variance for July is:<br>A)$828

Q16: Marusarz Corporation has provided the following data

Q26: The variable overhead efficiency variance for May

Q26: The management of Fannin Corporation is considering

Q74: The predetermined overhead rate is closest to:<br>A)$21.90

Q79: The activity variance for administrative expenses in

Q79: A direct materials quantity standard generally includes

Q218: The manufacturing overhead in the flexible budget

Q296: The spending variance for medical supplies in