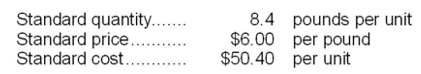

Melrose Corporation makes a product that uses a material with the following standards:

The company budgeted for production of 5,800 units in September, but actual production was 5,900 units. The company used 50,210 pounds of direct material to produce this output. The company purchased 55,100 pounds of the direct material at $5.80 per pound.

The direct materials purchases variance is computed when the materials are purchased.

-The materials price variance for September is:

Definitions:

Auctioning Off

The process of selling an item to the highest bidder through a competitive bidding process, commonly used for selling goods, property, or services.

Import Quota

A government-imposed limit on the quantity of a specific good that can be imported into a country within a given timeframe.

Specific Tariff

A fixed fee imposed on imported goods based on quantity, such as units, weight, or volume, rather than value.

Ad Valorem Tariff

A tax imposed on imported goods, calculated as a percentage of the value of the imports rather than a fixed rate.

Q13: The net operating income in the planning

Q37: Mutskic Corporation produces and sells Product BetaC.

Q38: The fixed manufacturing overhead budget variance for

Q39: The overall revenue and spending variance (i.e.,

Q68: Ok Corporation keeps careful track of the

Q107: The activity variance for administrative expenses in

Q146: The activity variance for administrative expenses in

Q150: Suppose Melrose can sell 68,000 units of

Q203: Randt Footwear Corporation's flexible budget cost formula

Q234: The facility expenses in the flexible budget