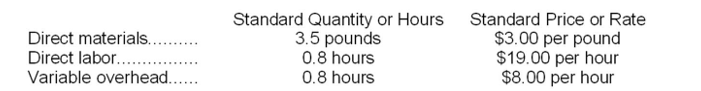

Epley Corporation makes a product with the following standard costs:

In July the company produced 3,300 units using 12,240 pounds of the direct material and 2,760 direct labor-hours. During the month, the company purchased 13,000 pounds of the direct material at a cost of $35,100. The actual direct labor cost was $51,612 and the actual variable overhead cost was $20,148.

The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased.

-The variable overhead rate variance for July is:

Definitions:

Vertical Integration

A business strategy where a company controls multiple stages of production, distribution, or supply chain within the same industry to increase control and reduce costs.

Creative Accounting

Practices that may push the boundaries of standard accounting rules to depict a more favorable financial picture of a business, sometimes straddling the line of legality.

Management-labor Relations

The dynamics and interactions between employers (management) and employees (labor), especially regarding negotiations, disputes, and working conditions.

Waldorf-Astoria Statement

A declaration made by major Hollywood studios in 1927 at the Waldorf-Astoria Hotel, which marked the industry's formal decision to transition from silent to sound films.

Q4: In a flexible budget performance report, actual

Q4: Liukko Corporation's standard wage rate is $14.90

Q25: The following standards have been established for

Q50: Fruchter Corporation keeps careful track of the

Q81: Sholette Manufacturing Corporation has a standard cost

Q86: Kerbow Corporation uses part B76 in one

Q93: In a merchandising company, the required merchandise

Q105: The variable overhead efficiency variance for January

Q210: The revenue variance for February would be

Q226: The food and supplies in the flexible