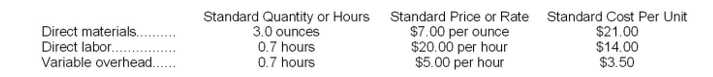

Oddo Corporation makes a product with the following standard costs:

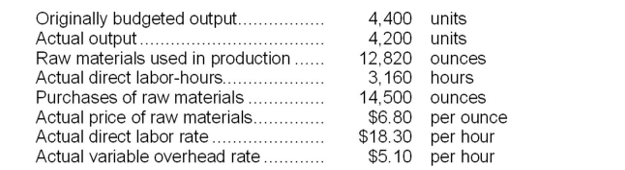

The company reported the following results concerning this product in December.

The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased.

-The labor efficiency variance for December is:

Definitions:

Sales Tax

A tax levied by a government on the sale of goods and services, typically calculated as a percentage of the selling price.

Excise Taxes

Taxes imposed on specific goods, services, or activities, often used to discourage consumption of certain items or to raise revenue for targeted purposes.

Consumption Taxes

Taxes imposed on spending on goods and services, such as sales tax or Value Added Tax (VAT).

Average Tax Rate

The percentage of gross income that goes towards tax payments, determined by dividing the sum of taxes paid by the gross income.

Q17: Directly comparing static budget costs to actual

Q33: For purposes of measuring performance, how much

Q38: The following standards have been established for

Q40: The labor rate variance for April is:<br>A)$1,575

Q56: Wait time is considered non-value-added time.

Q85: What was Vette's fixed manufacturing overhead budget

Q101: Acuff Corporation applies manufacturing overhead to products

Q102: Suppose a company evaluates divisional performance using

Q130: The cash budget is typically prepared before

Q291: The wages and salaries in the planning