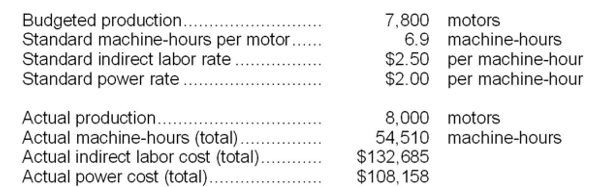

The following data have been provided by Petri Corporation:

Indirect labor and power are both elements of variable manufacturing overhead.

-The variable overhead rate variance for indirect labor is closest to:

Definitions:

Debt-Equity Ratio

The ratio indicating a corporation's reliance on debt financing, found by dividing its total debts by the equity held by its shareholders.

After-Tax Cost of Debt

The net cost of debt after accounting for the effects of taxes, reflecting the actual cost to a company.

Cost of Equity

The theoretical compensation paid by a company to its equity investors, or shareholders, for the risk involved in investing their capital.

Weighted Average Cost of Capital (WACC)

The average rate of return a company is expected to pay to all its security holders to finance its assets.

Q3: What was the West Division's minimum required

Q4: How much Logistics Department cost should be

Q22: What total amount of manufacturing overhead cost

Q72: Denby Corporation applies manufacturing overhead to products

Q127: The budgeted direct labor cost per unit

Q137: The variable overhead rate variance for supplies

Q144: The spending variance for manufacturing overhead in

Q163: During November, Guerreiro Clinic budgeted for 2,200

Q181: The materials quantity variance for March is:<br>A)$4,500

Q292: The activity variance for direct labor in