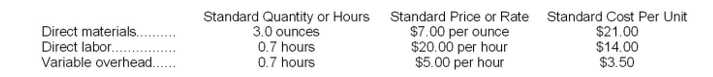

Oddo Corporation makes a product with the following standard costs:

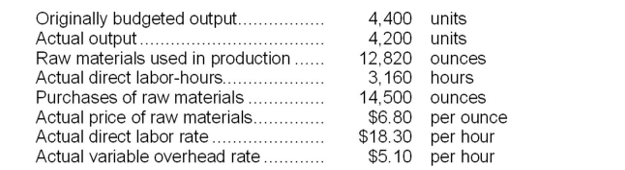

The company reported the following results concerning this product in December.

The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased.

-The labor efficiency variance for December is:

Definitions:

S&P 500 Portfolio

A portfolio of investments that aims to mimic the performance of the S&P 500, a stock market index that measures the stock performance of 500 large companies listed on stock exchanges in the United States.

Market Portfolio

A theoretical portfolio of all investable assets, weighted by market capitalization, that represents the entire market.

World Equities

Shares in companies located around the globe, representing ownership across different countries and industries.

Risk-free Rate

The Risk-free Rate is the theoretical return on an investment with no risk of financial loss, typically represented by government bonds.

Q4: The selling division in a transfer pricing

Q13: The following information was taken from the

Q28: The Western Division of Pryto Corporation sells

Q46: For performance evaluation purposes, how much of

Q69: Benjamin Signal Company produces products R, J,

Q72: The net operating income in the planning

Q76: When preparing a direct materials budget, the

Q103: The March 31 balance in accounts receivable

Q133: Fixed costs should be included in a

Q291: The wages and salaries in the planning