Miao Clinic uses client-visits as its measure of activity. During July, the clinic budgeted for 3,000 client-visits, but its actual level of activity was 2,980 client-visits. The clinic has provided the following data concerning the formulas used in its budgeting and its actual results for July:

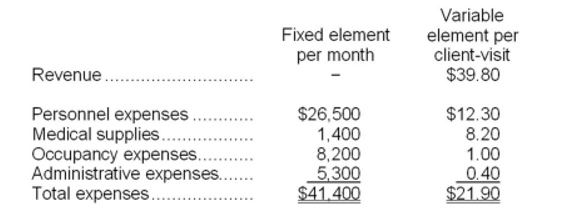

Data used in budgeting:

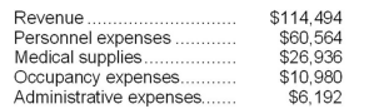

Actual results for July:

-The spending variance for medical supplies in July would be closest to:

Definitions:

Enlightenment Thinking

A philosophical movement of the 18th century, emphasizing reason, individualism, and skepticism towards traditional doctrines.

Stamp Act

A 1765 British law imposing a tax on all paper documents in the American colonies, leading to widespread protest and contributing to the American Revolutionary movement.

Parliamentary Authority

A set of rules that governs how procedures are carried out in a deliberative assembly, especially within a legislature following the parliamentary system.

Indirect Tax

A tax collected by an intermediary (such as a retailer) from the person who bears the ultimate economic burden of the tax (such as the consumer).

Q3: The budgeted accounts receivable balance on February

Q11: The wages and salaries in the planning

Q18: Mintzberg identified a key rigidity of the

Q25: The predetermined overhead rate per MH is

Q49: A company has a standard cost system

Q82: The materials quantity variance for May is:<br>A)$1,650

Q104: The standard cost card for a product

Q109: Rossetto Corporation bases its budgets on the

Q152: Vandel Inc. bases its selling and administrative

Q208: Lineback Corporation bases its budgets on the