Sorrow Kennel uses tenant-days as its measure of activity; an animal housed in the kennel for one day is counted as one tenant-day. During November, the kennel budgeted for 2,300 tenant-days, but its actual level of activity was 2,350 tenant-days. The kennel has provided the following data concerning the formulas used in its budgeting and its actual results for November:

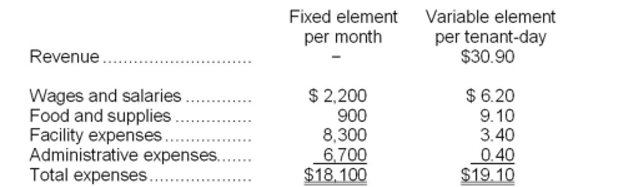

Data used in budgeting:

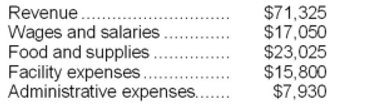

Actual results for November:

-The activity variance for net operating income in November would be closest to:

Definitions:

Taxable Incomes

The portion of an individual's or corporation's income used to determine how much tax is owed to the government.

Tax Bracket

A range of incomes taxed at a given rate, used in a progressive tax system to ensure fairness.

Taxable Income

The amount of an individual's or a corporation's income used to determine how much tax they owe to the government in a given tax year.

Deductions

Amounts that are subtracted from income before it is subjected to taxation, decreasing the total taxable income amount.

Q4: Global industries are those where:<br>A)International trade (imports

Q18: Achieving social legitimacy requires that businesses should:<br>A)Seek

Q21: On a cash budget, the total amount

Q25: The predetermined overhead rate per MH is

Q35: The expression "conglomerate discount" means:<br>A)The ability of

Q49: In large multibusiness,multinational companies shared service organizations

Q49: The spending variance for cleaning equipment and

Q87: Hairr Corporation bases its predetermined overhead rate

Q158: The net operating income in the flexible

Q179: What is Holiday's labor rate variance for