Pearse Kennel uses tenant-days as its measure of activity; an animal housed in the kennel for one day is counted as one tenant-day. During December, the kennel budgeted for 3,000 tenant-days, but its actual level of activity was 2,980 tenant-days. The kennel has provided the following data concerning the formulas used in its budgeting and its actual results for December:

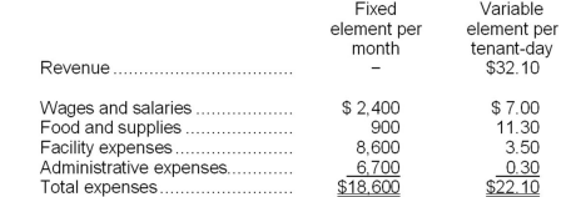

Data used in budgeting:

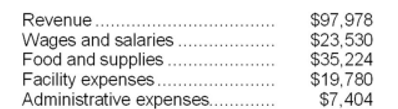

Actual results for December:

-The activity variance for net operating income in December would be closest to:

Definitions:

Gain

The financial benefit obtained when the selling price of an asset exceeds its purchase price.

Assumes Liability

Taking on the legal responsibility for a debt or obligation.

Realized Gain

Profit from the sale of an asset or investment when the selling price exceeds the original purchase price.

Ordinary Income

Income earned through standard operations, including wages, salaries, commissions, and interest income, typically taxed at normal rates.

Q4: The manufacturing overhead budget of Paparella Corporation

Q6: A major reason for the trend to

Q8: The variable overhead rate variance for power

Q13: During a recent lengthy strike at Morell

Q32: The materials quantity variance for May is:<br>A)$7,200

Q66: Which of the following would produce a

Q67: The higher the denominator activity level used

Q88: Tetrault Jeep Tours operates jeep tours in

Q109: Tropiano Electronics Corporation has a standard cost

Q182: The facility expenses in the flexible budget