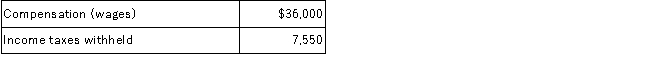

The following data were provided by the detailed payroll records of Mountain Corporation for the last week of March 2017, which will not be paid until April 5, 2017:  FICA taxes at a 7.65% rate (no employee had reached the maximum).

FICA taxes at a 7.65% rate (no employee had reached the maximum).

Required:

A.Prepare the March 31, 2017 journal entry to record the payroll and the related employee deductions.

B.Prepare the March 31, 2017 journal entry to record the employer's FICA payroll tax expense.

C.Calculate the total payroll-related liabilities at March 31, 2017 using the results of requirements (A) and (B).

Definitions:

Memorandum

A written record or communication used in business or diplomacy to officially document and share information.

Oral Contract

An agreement between parties that is spoken and not formally recorded in writing, yet is still legally binding under certain conditions.

Written Contract

A legally binding agreement documented in written form between parties, outlining terms and conditions.

Single Document

A term for an item typically consisting of written content on a single piece of paper or digital file, serving a specific informational or operational purpose.

Q2: The allowance for doubtful accounts is reported

Q15: Free cash flow measures the sufficiency of

Q26: Cash received from customers may result in

Q33: Which of the following is not included

Q38: The following information is provided for Bold

Q58: Which of the following statements correctly describes

Q59: Dora Company declared and distributed a 10%

Q80: On January 1, 2016, a company issued

Q121: One of Hawk Company's customers returned products

Q129: One of Trent Company's customers returned products