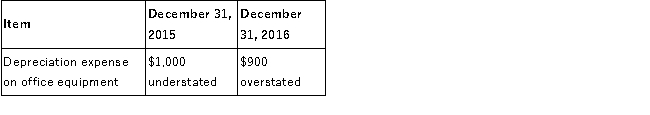

The financial statements of Franklin Company contained the following errors:  Required:

Required:

A.Was net income for 2015 understated or overstated? Briefly explain your answer.

B.1.Considering the effect of the errors of both years at December 31, 2016, is retained earnings overstated or understated, and by what amount?

2.Briefly explain your answer to part B (1).

Definitions:

FIFO Method

"First In, First Out," an inventory valuation method where the oldest stock is sold first, assuming that goods are sold in the order they were acquired.

Conversion Costs

The sum of labor and overhead costs required to convert raw materials into finished goods.

Equivalent Units

A method to express the amount of work done on partially completed goods in terms of fully completed units.

FIFO Method

An inventory valuation method that assumes items bought or manufactured first are sold first, standing for "First In, First Out."

Q13: An overstatement of the 2015 ending inventory

Q30: Rocket Corporation entered into the following transactions:

Q38: Accrued revenues are revenues that have been

Q57: The accrual of interest results in the

Q73: Which of the following transactions and events

Q75: Which of the following does not correctly

Q79: Merchandise was sold on credit for $30,000,

Q82: Cash equivalents such as treasury bills are

Q103: Which one of the following would not

Q110: Twin Lakes, Inc. reported the following December