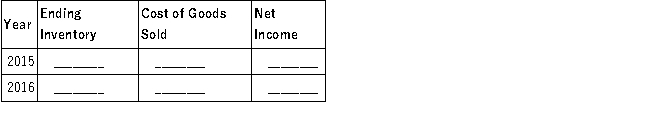

Redford Company hired a new store manager in October 2015, who determined the ending inventory on December 31, 2015, to be $50,000. In March, 2016, the company discovered that the December 31, 2015 ending inventory should have been $58,000. The December 31, 2016, inventory was correct. Ignore income taxes.

Required:

Complete the following table to show the effects of the inventory error on the four amounts listed. Give the amount of the discrepancy and indicate whether it was overstated (O), understated (U), or had no effect (N).

Definitions:

Profit-Maximizing Climate

An environment in business operations where the primary focus is on increasing profits to the highest possible level.

Conventional Morality

A stage in Kohlberg's theory of moral development where individuals make ethical decisions based on societal laws and the approval of others.

Aesthetic Person

An individual who appreciates and is sensitive to beauty in art, nature, and everyday life.

Q3: Which of the following results in a

Q11: What is the effect on the financial

Q18: Gains and losses on disposal of a

Q22: A deposit in transit in a bank

Q30: Rocket Corporation entered into the following transactions:

Q35: Effective internal control of cash should include

Q79: The total asset turnover ratio measures sales

Q101: On January 1, 2016, Jason Company issued

Q122: Salvia Company recently purchased a truck. The

Q136: Hopkins Company reported the following information related