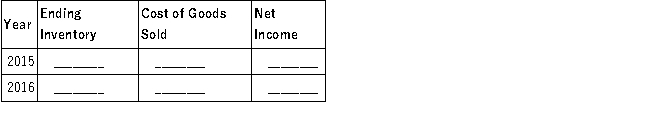

Redford Company hired a new store manager in October 2015, who determined the ending inventory on December 31, 2015, to be $50,000. In March, 2016, the company discovered that the December 31, 2015 ending inventory should have been $58,000. The December 31, 2016, inventory was correct. Ignore income taxes.

Required:

Complete the following table to show the effects of the inventory error on the four amounts listed. Give the amount of the discrepancy and indicate whether it was overstated (O), understated (U), or had no effect (N).

Definitions:

Right Lymphatic Duct

A vessel in the lymphatic system that drains lymph from the right upper limb, right side of the thorax, and right halves of the head and neck.

Brachiocephalic

Refers to the vein or artery that supplies blood to the arms and the head, particularly prominent in the circulatory system.

Subclavian Vein

A major vein that receives blood from the arm and parts of the neck and chest, located under the collarbone.

White Blood Cells

Defense cells in the immune system tasked with safeguarding the body against infections and foreign entities.

Q3: Dillon Company uses the allowance method to

Q5: The annual interest rate specified within a

Q10: Ridgetop Company issued the following ten-year bonds

Q24: Phipps Company borrowed $25,000 cash on October

Q27: A recent annual report for Kirova Company

Q67: Which of the following account balances would

Q80: Net sales plus cost of goods sold

Q85: A current liability is always a short-term

Q90: A contingent liability can not be disclosed

Q125: The first step in recording the disposal