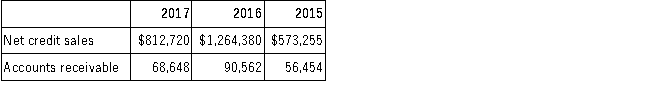

Matrix Corp. reported the following figures from its financial statements for the years 2015 through 2017.  Required:

Required:

A.Calculate for 2017:

1.Accounts receivable turnover

2.Average collection period

B.Calculate for 2016:

1.Accounts receivable turnover

2.Average collection period

C.Interpret the receivables turnover and the average collection period, in general.Comment on the change in the ratio results from 2016 to 2017.Then discuss how the trend in sales from 2015 to 2016 and 2017 may have affected the change in the ratios from 2016 to 2017.

Definitions:

Percentage Tax Rate

The portion of one's income or the cost of a transaction that must be paid as tax, expressed as a percentage.

Federal Personal Income Tax

A tax levied by the federal government on the annual income of individuals, households, and other legal entities.

Tax Bracket

A tax bracket is a range of incomes taxed at a particular rate within a tax system, influencing how much individuals or entities owe to the government.

Marginal Tax Rate

The rate of additional federal income tax to be paid on an extra dollar of income.

Q3: Which of the following includes only intangible

Q26: On November 1, 2016, Bruce Company leased

Q46: Unearned revenue is reported on the balance

Q47: During 2016, the Bowtie Company reported net

Q65: In what order are cash flow activities

Q70: On November 1, 2016, Bug Busters collected

Q81: The return on assets ratio is affected

Q82: Which of the following businesses would not

Q114: Which of the following statements about asset

Q135: Which of the following statements does not