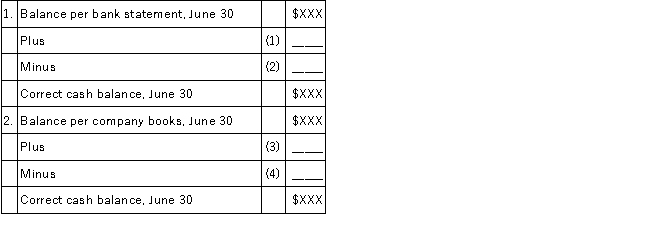

Select the appropriate answer choice A through G (listed below) to correspond with the following numbered items on a bank reconciliation. There may be more than one letter selection for the numbered item.  Items:A. Checks written during June that had not cleared the bank by June 30.

Items:A. Checks written during June that had not cleared the bank by June 30.

B. Bank service charges for June, which were not known until the June 30th bank statement arrived.

C. Deposit made on June 30 that did not reach the bank until July 1.

D. Upon reviewing the company's cash receipts book after June 30, it was discovered the accounting clerk had neglected to post one receipt to the cash account.

E. The bank statement reported a "NSF check" during June.

F. The bank incorrectly deducted the check of another company to the bank account during June.

G. The company was paid interest on its account by the bank.

Definitions:

Sales Revenue

The income received from selling goods or services over a given period of time before any deductions are made for costs or expenses.

Other Expenses

Expenses that are not directly tied to the production of goods or services but are necessary for the overall operation of the business.

Freight-Out

Costs associated with shipping products to customers, typically classified as a selling expense.

Interest Expense

The cost incurred by an entity for borrowed funds, which is considered a non-operating expense on the income statement.

Q7: Which of the following liability accounts is

Q14: Which of the following describes the effect

Q20: Corporate governance refers to the procedures designed

Q22: World Coffee, Inc. has provided the following

Q61: Which of the following liability accounts does

Q64: Describe the debit and credit logic pertaining

Q91: On October 1, 2016, Adams Company paid

Q96: Flyer Company has provided the following information

Q126: You have a goal of having $100,000

Q127: The year-end closing process transfers net income