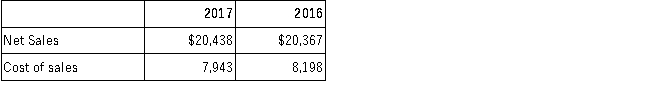

Anthony Inc. reported the following amounts on its 2016 and 2017 income statements:  Requirements:

Requirements:

A.Compute the gross profit percentage for years 2016 and 2017.

B.Provide at least two potential causes for the change in Anthony's gross profit percentage.

Definitions:

Property

Assets owned by a person or a company, encompassing both physical objects and intellectual property.

Life Insurance Proceeds

The money paid to the beneficiaries of a life insurance policy when the insured person passes away.

Gross Income

Total income from all sources before deductions, exemptions, and taxes.

Insured

A person or entity covered under an insurance policy, providing protection against specified risks or losses.

Q11: Which of the following accounts does not

Q20: Which of the following statements is correct?<br>A)Balance

Q28: Barkley Company has a piece of equipment

Q43: At the end of the accounting period,

Q50: Illinois Company prepared the following bank reconciliation

Q68: Maxim Corp. has provided the following information

Q88: Schager Company purchased a computer system on

Q98: Which of the following properly describes the

Q110: Which of the following statements is correct?<br>A)The

Q117: The following information is available for Coca-Cola