Four transactions described below were completed during 2016 by Russell Company. The books are adjusted only at year-end.

A.On December 31, 2016, Russell Company owed employees $3,750 for wages that were earned by them during December and were not recorded.

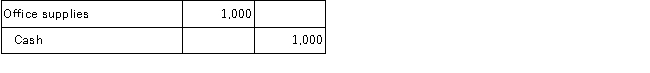

B.During 2016, Russell Company purchased office supplies that cost $1,000, which were placed in the supplies room for use as needed.The purchase was recorded as follows:

At January 1, 2016, the amount of unused office supplies was $300.At December 31, 2016, a physical count showed unused office supplies in the supply room amounting to $100.

At January 1, 2016, the amount of unused office supplies was $300.At December 31, 2016, a physical count showed unused office supplies in the supply room amounting to $100.

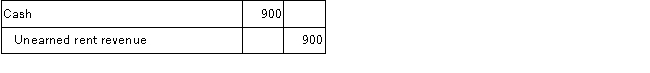

C.On December 1, 2016, Russell Company rented some office space to another party.Russell Company collected $900 rent for the period December 1, 2016, to March 1, 2016.The December 1 transaction was recorded as follows:

D.On July 1, 2016, Russell Company borrowed $12,000 cash on a one-year, 8% interest-bearing, note payable.The interest is payable on the due date of the note, June 30, 2017.The borrowing was recorded as follows on July 1, 2016:

Definitions:

Debt

Debt is an obligation or liability owed by one party to another, typically involving borrowed money that is to be paid back with interest.

Denominations

Refers to distinct religious groups within a larger faith, typically differing in organization, practice, and beliefs.

Methodist

A denomination of Protestant Christianity emphasizing a personal relationship with Jesus Christ, social justice, and the universality of God's grace.

Baptist

Baptist denominations are groups within Christianity known for practicing believer's baptism (as opposed to infant baptism) and upholding the autonomy of local congregations.

Q27: Stockholders' equity, also called shareholders' equity, includes

Q28: Determine the effect of the following errors

Q39: The normal balance for an asset account

Q73: Lantz Company has provided the following information:

Q81: Newark Company has provided the following information:

Q87: Which of the following is not a

Q100: Lantz Company has provided the following information:

Q123: How are creditor and investor claims reported

Q123: When a credit sale is made with

Q128: Which of the following best describes the