Four transactions described below were completed during 2016 by Russell Company. The books are adjusted only at year-end.

A.On December 31, 2016, Russell Company owed employees $3,750 for wages that were earned by them during December and were not recorded.

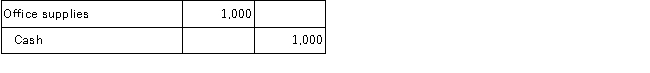

B.During 2016, Russell Company purchased office supplies that cost $1,000, which were placed in the supplies room for use as needed.The purchase was recorded as follows:

At January 1, 2016, the amount of unused office supplies was $300.At December 31, 2016, a physical count showed unused office supplies in the supply room amounting to $100.

At January 1, 2016, the amount of unused office supplies was $300.At December 31, 2016, a physical count showed unused office supplies in the supply room amounting to $100.

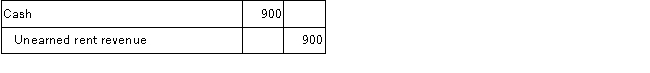

C.On December 1, 2016, Russell Company rented some office space to another party.Russell Company collected $900 rent for the period December 1, 2016, to March 1, 2016.The December 1 transaction was recorded as follows:

D.On July 1, 2016, Russell Company borrowed $12,000 cash on a one-year, 8% interest-bearing, note payable.The interest is payable on the due date of the note, June 30, 2017.The borrowing was recorded as follows on July 1, 2016:

Definitions:

Q14: The Statement of Comprehensive Income includes items

Q25: On June 1, 2016, Concorde Company sold

Q33: A portion of the income statement for

Q35: Effective internal control of cash should include

Q49: The Willie Company has provided the following

Q67: Borrowing money is an investing activity.

Q69: Which financial statement would you utilize to

Q75: Which of the following does not correctly

Q113: Which of the following would cause a

Q114: Which of the following journal entries correctly