Three transactions described below were completed during 2016 by Story Company.

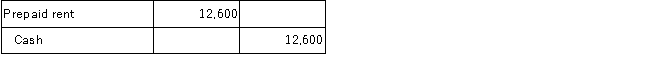

A.On June 1, 2016, Story Company paid $12,600 for one year's rent beginning on that date.The rent payment was recorded as follows:

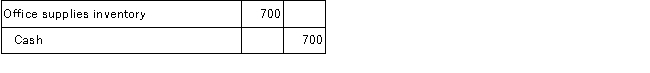

B.On February 1, 2016, Story Company purchased office supplies during the year that cost $700 and placed the supplies in a storeroom for use as needed.The purchase was recorded as follows:

At December 31, 2016, a count showed unused office supplies of $200 in the storeroom.There was no beginning inventory of supplies on hand.

At December 31, 2016, a count showed unused office supplies of $200 in the storeroom.There was no beginning inventory of supplies on hand.

C.On December 31, 2016, Story Company owed employees $2,000 for wages earned during December.These wages had not been paid or recorded.Required:

Prepare the adjusting entries as of December 31, 2016, assuming no adjusting entries have been made during the year.

Definitions:

Calcitonin

A hormone produced by the thyroid gland that helps regulate calcium levels in the blood.

Kidneys

Pair of bean-shaped organs located in the back of the abdomen that filter waste products from the blood and excrete them as urine.

Collecting Ducts

A network of tubules and ducts that function in the kidney to transport urine from the nephrons to the renal pelvis.

ADH

An acronym for Alcohol Dehydrogenase, an enzyme involved in metabolizing alcohol by converting it into acetaldehyde.

Q7: Revenue is recognized within the income statement

Q13: Financial analysts utilize a company's financial reports

Q23: Use of the equity method is required

Q27: Which of the following would be reported

Q60: With regard to relationships among financial statements,

Q67: Stockholders' equity reflects the financing provided by

Q83: On January 1, 2016, Turtle Inc. bought

Q98: Prior year financial statements are adjusted when

Q107: Subsequent to a merger, the assets and

Q119: Atomic Company did not record a December