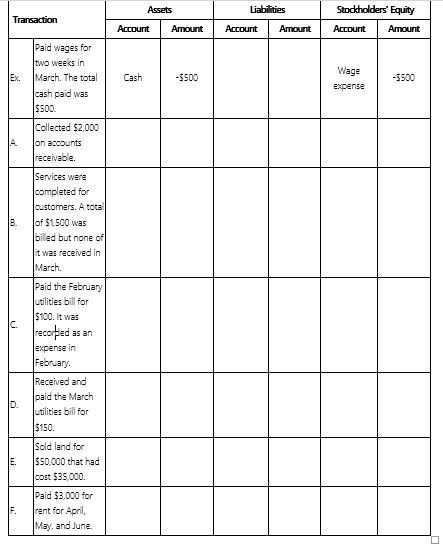

Part A. Perform transaction analysis for Blake Company regarding the following transactions for the month of March. Indicate the account affected by the transaction as well as the increase (+) or decrease (-) to the components of the accounting equation and the amount.

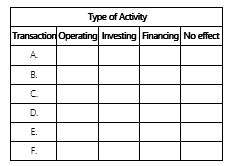

Part B. Determine whether the transactions A-F above affected cash flows during March. If so, determine the type of activity as an operating activity, an investing activity, or a financing activity. If cash is not affected use "no effect." Place an X under the appropriate column for each transaction.

Part B. Determine whether the transactions A-F above affected cash flows during March. If so, determine the type of activity as an operating activity, an investing activity, or a financing activity. If cash is not affected use "no effect." Place an X under the appropriate column for each transaction.

A.

A.Collected $2,000 on accounts receivable.

A.Perform transaction analysis for Blake Company regarding the following transactions for the month of March.Indicate the account affected by the transaction as well as the increase (+) or decrease (-) to the components of the accounting equation and the amount.Transaction

Assets

Liabilities

Stockholders' Equity

Account

Amount

Account

Amount

Account

Amount

Ex.Paid wages for two weeks in March.The total cash paid was $500.Cash

-$500

Wage expense

-$500

B.

B.Services were completed for customers.A total of $1,500 was billed but none of it was received in March.

Definitions:

Incapacitated

A state in which an individual or entity is unable to act or respond due to injury, illness, or other impairments.

Drugs

Substances used for medical purposes to diagnose, cure, treat, or prevent disease, or otherwise used to alter one's physiological or psychological state.

Alcohol

A chemical compound, specifically ethanol, often consumed as a recreational beverage, and known for its psychoactive and depressant effects.

Hidden Expectations

Implicit expectations within a project or work environment that are not clearly documented or acknowledged.

Q15: Which of the following does not correctly

Q18: What is the objective of the cash

Q22: Where are shares of the reporting company's

Q25: Which of the following equations is the

Q31: On September 1, 2016, Fast Track, Inc.

Q40: On January 1, American Company's allowance for

Q53: The revenue recognition principle recognizes revenue when

Q53: Under the monetary unit assumption, accounting information

Q75: If a bond is bought at a

Q117: Closing the expense and loss accounts at