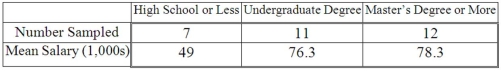

A random sample of 30 executives from companies with assets over $1 million was selected and asked for their annual income and level of education. The ANOVA comparing the average income among three levels of education rejected the null hypothesis. The Mean Square Error (MSE) was 243.7. The following table summarized the results:  When comparing the mean annual incomes for executives with undergraduate and master's degrees or more, the following 95% confidence interval can be constructed:

When comparing the mean annual incomes for executives with undergraduate and master's degrees or more, the following 95% confidence interval can be constructed:

Definitions:

Assets Reporting

The process of documenting and disclosing the value and details of a company’s assets in financial statements.

Net Assets

The total value of all a company's assets after subtracting liabilities; an indication of the company's net worth.

GAAP

Generally Accepted Accounting Principles, a common set of accounting principles, standards, and procedures that companies must follow when they compile their financial statements in the United States.

IFRS

International Financial Reporting Standards, a set of accounting standards developed by the International Accounting Standards Board (IASB) aimed at providing a global framework for financial reporting.

Q11: A local company wants to evaluate their

Q30: If we are testing for the difference

Q59: To compare the effect of weather on

Q64: The minimum and maximum of values of

Q70: If the decision is to reject the

Q79: A(n) _ estimate states the range within

Q81: A statement about the value of a

Q92: A company compared the variance of salaries

Q99: The critical t statistic for an alternative

Q109: The estimate of the population proportion is