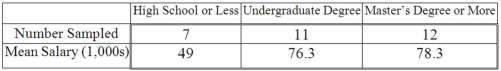

A random sample of 30 executives from companies with assets over $1 million was selected and asked for their annual income and level of education. The ANOVA comparing the average income among three levels of education rejected the null hypothesis. The Mean Square Error (MSE) was 243.7. The following table summarized the results:  Based on the comparison between the mean annual incomes for executives with undergraduate and master's degrees or more ________________.

Based on the comparison between the mean annual incomes for executives with undergraduate and master's degrees or more ________________.

Definitions:

Fiscal Policy

Government policies regarding taxation and spending that influence economic conditions.

Lower Taxes

The reduction of tax rates or tax burdens to encourage economic activities or provide relief to taxpayers.

Increased Government Spending

A fiscal policy where the government expands its expenditures to stimulate economic growth or address public needs.

Annual Budget

A financial document forecasted for a year that outlines expected income and expenditure for an organization or government.

Q7: Homer sharpens a rock and uses it

Q30: We are interested in knowing if the

Q48: In multiple regression analysis, residuals (Y -

Q62: A manager at a local bank analyzed

Q70: According to the central limit theorem, _.<br>A)Sample

Q77: As the sample size (n) increases, the

Q92: The chi-square distribution is positively skewed.

Q93: If a dependent variable and one of

Q100: A student wanted to construct a 95%

Q103: Of the following characteristics, the t distribution