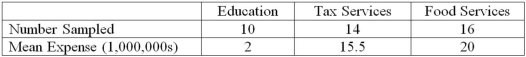

A random sample of 40 companies with assets over $10 million was surveyed and asked to indicate their industry and annual computer technology expense. The ANOVA comparing the average computer technology expense among three industries rejected the null hypothesis. The Mean Square Error (MSE) was 195. The following table summarized the results:  Based on the comparison between the mean annual computer technology expense for companies in the education and tax services industries, _________________.

Based on the comparison between the mean annual computer technology expense for companies in the education and tax services industries, _________________.

Definitions:

ROE

Return on Equity, a financial ratio indicating the profitability of a corporation in relation to stockholders’ equity, showing how well the company uses investments to generate earnings growth.

EPS

Earnings Per Share, a company's profit divided by the number of outstanding shares of its common stock, indicating the company's profitability.

EBIT

Earnings Before Interest and Taxes, a measure of a company's profit that includes all incomes and expenses except interest and income tax expenses.

ROCE

Return on Capital Employed; a measure of a company's profitability in relation to its capital, indicating how efficiently capital is being utilized to generate profits.

Q13: A manufacturer claims that less than 1%

Q23: The Russian cultural-historical school emphasized that<br>A)mind and

Q23: The standard error of the estimate measures

Q33: A manufacturer of automobile transmissions uses three

Q76: To determine the size of a sample,

Q79: A random sample of 30 executives from

Q80: The mean annual incomes of certified welders

Q80: A survey of 50 retail stores revealed

Q86: In ANOVA analyses, when the null hypothesis

Q122: In multiple regression analysis, testing the global