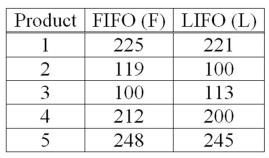

Accounting procedures allow a business to evaluate their inventory costs based on two methods: LIFO (Last In First Out) or FIFO (First In First Out) . A manufacturer evaluated its finished goods inventory (in $000s) for five products with the LIFO and FIFO methods. To analyze the difference, they computed (FIFO - LIFO) for each product. Based on the following results, does the LIFO method result in a lower cost of inventory than the FIFO method?  What is the null hypothesis?

What is the null hypothesis?

Definitions:

Income Before Income Taxes

The profit a company has generated before accounting for income tax expenses, often found on the income statement.

Times Interest Earned Ratio

A financial metric that measures a company's ability to cover its interest obligations with its earnings before interest and taxes (EBIT).

Potential Drop

An anticipated decrease in value or performance, often used in the context of stocks or electrical voltage.

Earnings

The profit a company generates during a particular period, often used as a measure of its financial performance.

Q14: Recently, students in a marketing research class

Q24: A recent study of the relationship between

Q45: For people released from prison, the following

Q58: One characteristic of the F distribution is

Q75: A machine cuts steel to length for

Q85: To conduct a test of hypothesis with

Q89: A population consists of 15 values. How

Q95: A _ analysis is used to develop

Q96: The minimum and maximum values of the

Q102: For a one-tailed test with a 0.05