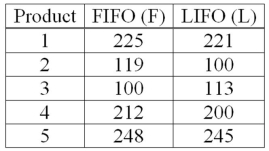

Accounting procedures allow a business to evaluate their inventory costs based on two methods: LIFO (Last In First Out) or FIFO (First In First Out) . A manufacturer evaluated its finished goods inventory (in $000s) for five products with the LIFO and FIFO methods. To analyze the difference, they computed (FIFO - LIFO) for each product. Based on the following results, does the LIFO method result in a lower cost of inventory than the FIFO method?  What is the alternate hypothesis?

What is the alternate hypothesis?

Definitions:

Internal Standard

A benchmark or criterion established within an organization to ensure consistency and quality in its operations or production.

Life-Cycle Costs

The total cost of owning, operating, maintaining, and disposing of a product or system over its life span.

Transactional Costs

Expenses incurred during trading, beyond the price of the goods, including search and information costs, bargaining costs, and enforcement costs.

Purchase Price

The amount of money paid to acquire a product or service.

Q2: The level of significance is the probability

Q30: The F distribution's curve is positively skewed.

Q35: For the hypothesis test, <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4677/.jpg" alt="For

Q40: If a hypothesis states that one population

Q58: One characteristic of the F distribution is

Q91: For a given confidence level, the value

Q95: In a contingency table analysis, the decision

Q101: We can expect some difference between sample

Q102: In multiple regression, the _ is used

Q104: A research firm conducted a survey to