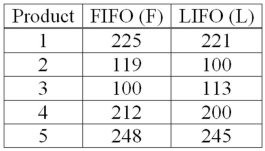

Accounting procedures allow a business to evaluate their inventory costs based on two methods: LIFO (Last In First Out) or FIFO (First In First Out) . A manufacturer evaluated its finished goods inventory (in $000s) for five products with the LIFO and FIFO methods. To analyze the difference, they computed (FIFO - LIFO) for each product. Based on the following results, does the LIFO method result in a lower cost of inventory than the FIFO method?  What are the degrees of freedom?

What are the degrees of freedom?

Definitions:

Test Validity

The extent to which a test accurately measures what it is supposed to measure.

Reliability

The extent to which a measurement instrument yields reliable and uniform outcomes.

Validity

The degree to which an idea, inference, or measurement is substantiated and probably accurately reflects reality.

Reliability

How much a testing tool delivers steady and dependable results throughout time.

Q6: When expressed as a percentage, what is

Q8: Which of the following is a point

Q27: When the population standard deviation is unknown,

Q37: It is claimed that in a bushel

Q41: A manufacturer claims that less than 1%

Q54: In a uniform distribution, with a minimum,

Q78: Twenty-one executives in a large corporation were

Q85: A recent study of the relationship between

Q87: A random sample of size 15 is

Q97: For a distribution of sample means with