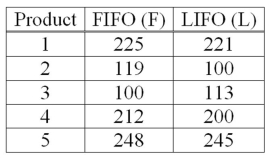

Accounting procedures allow a business to evaluate their inventory costs based on two methods: LIFO (Last In First Out) or FIFO (First In First Out) . A manufacturer evaluated its finished goods inventory (in $000s) for five products with the LIFO and FIFO methods. To analyze the difference, they computed (FIFO - LIFO) for each product. Based on the following results, does the LIFO method result in a lower cost of inventory than the FIFO method?  If you use the 5% level of significance, what is the critical t value?

If you use the 5% level of significance, what is the critical t value?

Definitions:

Normative Economics

A branch of economics that focuses on what ought to be or what should happen, often involving judgments and prescriptions for economic policy.

Positive Economics

A branch of economics that seeks to describe and explain the economy as it actually is, without making judgments about its effectiveness.

Judgments

Decisions or conclusions reached after consideration, often in a legal context or in personal assessment.

Empirical Economics

The branch of economics that focuses on using data and statistical methods to analyze and test economic theories.

Q16: The mean of any uniform probability distribution

Q28: A group of statistics students decided to

Q33: A confidence interval for a population mean

Q48: Which of the following statements is correct

Q54: A Type II error is the probability

Q55: The formula used to compute the standard

Q66: To compare the effect of weather on

Q96: A survey of property owners' opinions about

Q99: A 95% confidence interval implies that about

Q115: When testing the difference between two population