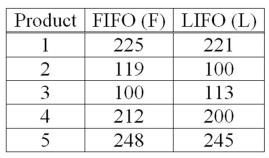

Accounting procedures allow a business to evaluate their inventory costs based on two methods: LIFO (Last In First Out) or FIFO (First In First Out) . A manufacturer evaluated its finished goods inventory (in $000s) for five products with the LIFO and FIFO methods. To analyze the difference, they computed (FIFO - LIFO) for each product. Based on the following results, does the LIFO method result in a lower cost of inventory than the FIFO method?  What is the null hypothesis?

What is the null hypothesis?

Definitions:

Q12: A company compared the variance of salaries

Q16: What is the test statistic to test

Q28: The best example of an alternate hypothesis

Q29: Using the following regression analysis: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4677/.jpg"

Q53: The standard deviation of any uniform probability

Q60: The time to fly between New York

Q71: The following correlations were computed as part

Q84: A multiple regression analysis showed the following

Q96: A group of statistics students decided to

Q110: A university has 1,000 computers available for