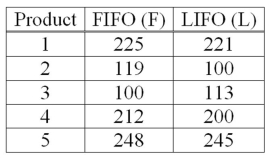

Accounting procedures allow a business to evaluate their inventory costs based on two methods: LIFO (Last In First Out) or FIFO (First In First Out) . A manufacturer evaluated its finished goods inventory (in $000s) for five products with the LIFO and FIFO methods. To analyze the difference, they computed (FIFO - LIFO) for each product. Based on the following results, does the LIFO method result in a lower cost of inventory than the FIFO method?  If you use the 5% level of significance, what is the critical t value?

If you use the 5% level of significance, what is the critical t value?

Definitions:

Employer

An individual or organization that hires and pays people to work.

Wages Expense

The total cost incurred by an organization to pay salaries and wages to its employees for a specific period.

Accrued Liability

A liability that has been incurred, is recognized on the balance sheet, and has not yet been paid.

Deferred Revenues

Deferred revenues are payments received by a company for goods or services that have not yet been delivered or performed, recognized as liabilities on the balance sheet.

Q17: If an employee wanted to investigate the

Q19: All values in an F distribution must

Q20: To compute a confidence interval for a

Q24: In regression analysis, error is defined as

Q47: A large manufacturing firm tests job applicants.

Q49: Which of the following is true regarding

Q58: A personnel manager is concerned about absenteeism.

Q63: Auditors may select every 20<sup>th</sup> file starting

Q74: A point estimate is a range of

Q99: The mean of a normal probability distribution