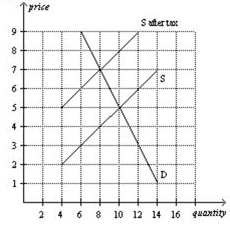

Using the graph shown, answer the following questions.

a. What was the equilibrium price in this market before the tax?

b. What is the amount of the tax?

c. How much of the tax will the buyers pay?

d. How much of the tax will the sellers pay?

e. How much will the buyer pay for the product after the tax is imposed?

f. How much will the seller receive after the tax is imposed?

g. As a result of the tax, what has happened to the level of market activity?

Definitions:

Interest Components

The different parts that make up the total interest calculation, including the principal amount, interest rate, and time period.

Principal

The original sum of money borrowed in a loan or the initial amount of investment, not including interest or profits.

Simple Interest

Interest assessed only on the base amount, or on whatever portion of the base amount has not been settled.

Interest

Payment made for the use of borrowed money, calculated as a percentage of the principal sum.

Q3: Suppose buyers of fountain drinks are required

Q196: ABC Company incurs a cost of 50

Q231: The Surgeon General announces that eating apples

Q285: Refer to Figure 7-24. If 6 units

Q324: Total surplus<br>A) can be used to measure

Q405: Refer to Figure 6-18. The amount of

Q407: Refer to Figure 6-32. If the government

Q410: Economists blame the long lines at gasoline

Q463: A simultaneous increase in both the demand

Q537: Price floors are typically imposed to benefit