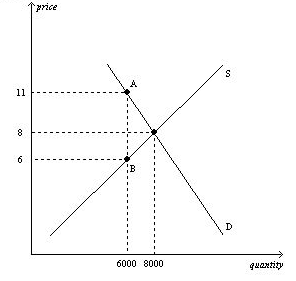

Using the graph shown, in which the vertical distance between points A and B represents the tax in the market, answer the following questions.

a. What was the equilibrium price and quantity in this market before the tax?

b. What is the amount of the tax?

c. How much of the tax will the buyers pay?

d. How much of the tax will the sellers pay?

e. How much will the buyer pay for the product after the tax is imposed?

f. How much will the seller receive after the tax is imposed?

g. As a result of the tax, what has happened to the level of market activity?

Definitions:

Natural Monopoly

A market condition where a single supplier is most efficient in providing goods or services due to high fixed or startup costs.

Economically Efficient

A situation where resources are allocated in a way that maximizes the net benefit to society.

Barriers To Entry

Factors that make it difficult for new firms to enter an industry, such as high initial investment, legal restrictions, or strong brand loyalty among consumers.

Network Effects

The phenomenon whereby increased numbers of people or participants improve the value of a good or service.

Q8: If a price ceiling of $1.50 per

Q104: Refer to Table 7-12. If the sellers

Q121: Refer to Figure 6-7. Which of the

Q122: Producer surplus equals the<br>A) value to buyers

Q141: Refer to Scenario 6-1. If the government

Q324: Total surplus<br>A) can be used to measure

Q366: If Darby values a soccer ball at

Q498: Laissez-faire is a French expression which literally

Q511: A $2.00 tax levied on the sellers

Q546: Refer to Figure 7-16. Suppose the price