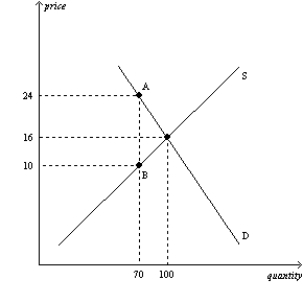

Figure 6-18

The vertical distance between points A and B represents the tax in the market.

-Refer to Figure 6-18.The per-unit burden of the tax on sellers is

Definitions:

Comprehensive Income

The total change in equity for a business enterprise during a period from transactions and other events and circumstances from non-owner sources.

Other Comprehensive Income

Elements of income that are not included in net income, including items like foreign currency translation adjustments and unrealized gains or losses on securities.

Retained Earnings

The portion of net income left over for the business after it has paid out dividends to its shareholders, often reinvested into the business.

Comprehensive Loss

Reflects the total net expenses, including all losses and expenses, surpassing the total revenues and gains over a period, thereby showcasing a negative net income on the financial statements.

Q15: Refer to Figure 6-31. If the government

Q20: The supply of oil is likely to

Q60: Which of the following is not true

Q63: Refer to Table 6-5. Suppose the government

Q164: Refer to Table 7-10. If the market

Q246: Suppose the government imposes a $40 tax

Q255: Refer to Figure 5-21. Using the midpoint

Q268: If the government levies a $1,000 tax

Q300: Refer to Figure 6-9. At which price

Q627: Refer to Figure 6-2. The price ceiling<br>A)