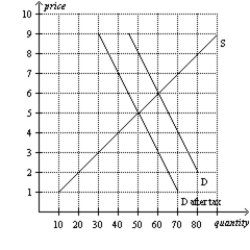

Figure 6-25

-Refer to Figure 6-25.Suppose the same supply and demand curves apply,and a tax of the same amount per unit as shown here is imposed.Now,however,the sellers of the good,rather than the buyers,are required to pay the tax to the government.After the sellers are required to pay the tax,relative to the case depicted in the graph,the burden on buyers will be

Definitions:

Perpetual Inventory System

An inventory accounting system where updates are made continuously as transactions occur, reflecting the real-time quantity of inventory on hand.

Cost Of Goods Sold

Costs pertaining directly to the crafting of goods a business sells, covering both labor and material expenses.

Perpetual Inventory System

An accounting method that records the sale or purchase of inventory immediately through the use of technology, ensuring continuous updating of inventory and cost of goods sold data.

Freight Costs

Expenses incurred by a company to ship its products to customers, usually varying based on distance and weight.

Q57: Dawn's bridal boutique is having a sale

Q62: Suppose that when the price rises by

Q106: Which of the following would be the

Q232: Economists normally assume people's preferences should be<br>A)

Q234: Price floors are typically imposed to benefit

Q289: The study of how the allocation of

Q489: The proportion of minimum-wage earners who are

Q499: You own a small town movie theatre.

Q523: A binding price floor will reduce a

Q586: Suppose demand is given by the equation: